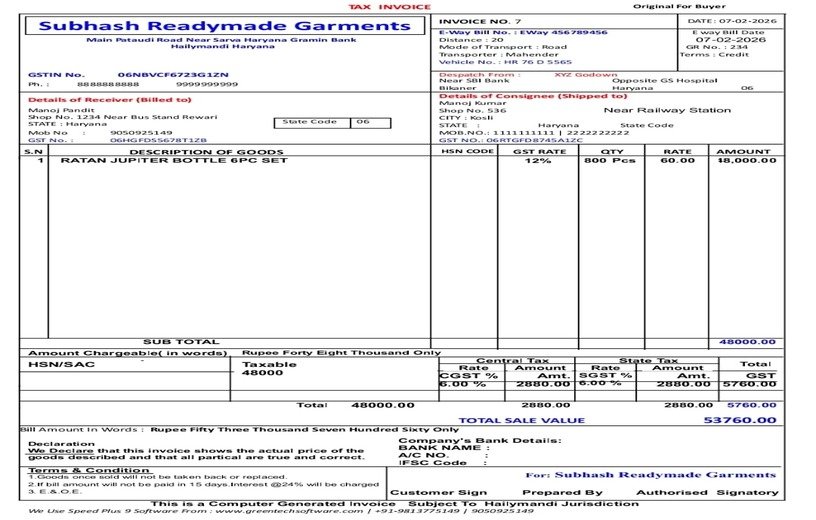

The Bill to Ship to – GST Bill Format Design is a professionally structured and GST-compliant invoice template created for businesses that raise an invoice to one party while delivering goods to another. This billing format is especially useful in B2B transactions, third-party logistics, job work, and multi-location supply chains.

Firstly, this format clearly separates the Bill To Party and Ship To Party details. The Bill To section includes the buyer’s name, address, GSTIN, and state code, while the Ship To section displays complete delivery details. As a result, there is no confusion during audits, transportation, or GST filing.

Moreover, the bill includes a dedicated Dispatched From section. This clearly mentions the warehouse, factory, or third-party location from where the goods are shipped. In practice, this helps businesses maintain transparency and comply with GST movement rules.

Furthermore, the invoice layout provides a well-defined area for E-Way Bill details, including E-Way Bill number, date, validity, and transporter information. Therefore, it becomes ideal for both interstate and intrastate goods movement without any compliance gaps.

In addition, the bill format supports a complete GST tax breakup, including CGST, SGST, and IGST, along with taxable value and total invoice amount. Most importantly, the structure follows GST standards, making it suitable for regular business use, audits, and record keeping.

Not only that, the design is clean, professional, and easy to read. It is print-ready and also optimized for digital sharing via PDF, WhatsApp, or email. Consequently, businesses can use the same format for both physical and electronic documentation.

Overall, this Bill to Ship to bill format is an ideal solution for manufacturers, traders, wholesalers, distributors, and ERP users who require accuracy, compliance, and clarity in their billing process. In conclusion, it helps streamline invoicing, reduce errors, and maintain full GST and E-Way Bill compliance with confidence.

🔹 Key Highlights

-

✅ Bill To Party Details

Name, address, GSTIN, state code, and contact information -

✅ Ship To Party Details

Complete delivery address, GSTIN, and state information -

✅ Dispatched From Section

Clearly mentions the warehouse, factory, or third-party location from where goods are shipped -

✅ E-Way Bill Details Included

E-Way Bill Number, date, validity, and transporter information -

✅ GST-Compliant Layout

Supports CGST, SGST, IGST with proper tax breakup -

✅ Professional & Clean Design

Easy to read, print-ready, and suitable for digital sharing (PDF / WhatsApp / Email) -

✅ Universal Business Use

Perfect for manufacturers, wholesalers, distributors, traders, and ERP software users

🔹 Who Should Use This Format?

-

Manufacturing units with third-party shipping

-

Traders billing head office but shipping to branch

-

Businesses using Bill to–Ship to supply model

-

ERP, accounting, and billing software users

-

GST-registered businesses needing E-Way Bill clarity

What You Get

-

📥 Instant downloadable bill format design

-

🧾 Ready-to-use professional invoice layout

-

📊 Structured sections for compliance and audits

-

📄 Printable and digital-friendly format